Historical cost accounting and mark-to-market, or fair value, accounting are two methods used to record the price or value of an asset. Historical cost measures the value of the original cost of an asset, whereas mark-to-market measures the current market value of the asset. The Framework says that historical cost may not provide relevant information about assets held for a long period of time, and are certainly unlikely to provide relevant information about derivatives. In both cases, it is likely that some variation of current value will be used to provide more predictive information to users. When an investor buys a 50 call option, they are buying the right to purchase 100 shares of stock at $50 per share for a specific period.

What Is Fair Value?

This would increase the total assets and the shareholders’ equity reported by XYZ Corp. by $500,000, compared to historical cost accounting. Many standards, such as International Accounting Standard (IAS®) 37 Provisions, Contingent Liabilities and Contingent Assets, apply a system of asymmetric prudence. In IAS 37, a probable outflow of economic benefits would be recognised as a provision, whereas a probable inflow would only be shown as a contingent asset and merely disclosed in the financial current value accounting statements. Therefore, two sides in the same court case could have differing accounting treatments despite the likelihood of the pay-out being identical for either party. Many respondents highlighted this asymmetric prudence as necessary under some accounting standards and felt that a discussion of the term was required. Whilst this is true, the Board believes that the Framework should not identify asymmetric prudence as a necessary characteristic of useful financial reporting.

Mark-to-Market Accounting vs. Historical Cost Accounting: What’s the Difference?

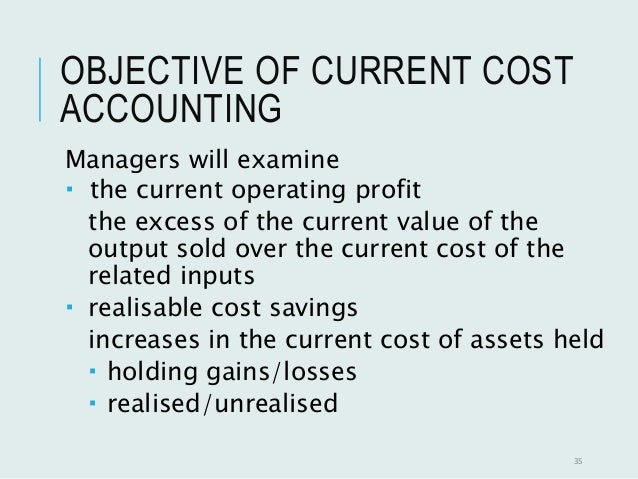

Current value accounting assets is a method of accounting that values assets at their current market value. This method is used to provide a more accurate picture of a company’s financial position. The main benefit of using the current value accounting method is that it provides a more accurate picture of a company’s financial position. It takes into account changes in market conditions, which can impact the value of assets and liabilities. This can be especially important in times of economic turmoil, when the market value of assets may be more volatile. Historical cost accounting is important to financial reporting because it provides an objective view, where the actual cost of the item can be traced.

Ask Any Financial Question

Another theory is speculative growth, which involves investing in companies with high growth potential but uncertain future cash flows. One such modern finance theory is fundamental investing, which involves analyzing a company’s financial statements to determine its intrinsic value and investing accordingly. Bonds and securities are considered less risky than equity investments because they offer a fixed rate of return and are typically backed by the issuer’s assets.

Which of these is most important for your financial advisor to have?

As these items are unlikely to be able to be sold separately without penalising the activities, a cost-based measure is likely to provide more relevant information, as the cost is compared to the margin made on sales. The Board has acknowledged that some IFRS Standards do include a probability criterion for recognising assets and liabilities. This is because it takes into account factors such as future growth potential and market demand for the company’s products or services.

What are the differences between historical cost accounting and current value accounting?

This method is based on a company’s past transactions and is conservative, easy to calculate, and reliable. Historical cost accounting is an accounting method in which the assets listed on a company’s financial statements are recorded based on the price at which they were originally purchased. The Framework states that the concept of prudence does not imply a need for asymmetry, such as the need for more persuasive evidence to support the recognition of assets than liabilities. It has included a statement that, in financial reporting standards, such asymmetry may sometimes arise as a consequence of requiring the most useful information.

However, these characteristics are subject to cost constraints, and it is therefore important to determine whether the benefits to users of the information justify the cost incurred by the entity providing it. The Framework clarifies what makes financial information useful, that is, information must be relevant and must faithfully represent the substance of financial information. In transactions large or small, both parties may consider a number of factors in determining fair value, including the recent prices of similar purchases and the real benefits of the purchase being considered. Fair value accounting measures assets and liabilities at estimates of their current value.

- Present value is a way of representing the current value of a future sum of money or future cash flows.

- OCI may not be recycled if there is no clear basis for identifying the period in which recycling should occur.

- Accounting values are the principles that govern the way financial information is recorded and reported.

- It helps investors, creditors, and other stakeholders to assess a company’s financial health, profitability, and risk profile.

It requires determining the right price between two parties depending on their interests, risk factors, and future goals for the asset. Fair value is most often used to gauge the true worth of an asset by looking at factors like its potential for growth or the cost to replace it. If a construction business acquired a truck worth $20,000 in 2019 and decided to sell the truck in 2022, comparable sale listings of the same used truck may include two trucks priced at $12,000 and $14,000. The estimated fair value of the truck may be determined as the average current market value, or $13,000. In investing, fair value is the price that investors are willing to pay to generate their desired price growth and rate of return. The amount of dividends paid to shareholders is determined by the company’s dividend policy, which may be influenced by factors such as the company’s financial performance and growth prospects.